How To Accept Online Payments

If you are wondering how to accept online payments via your website you’re in for a treat. I promise to give you the full scoop on the best way to accept payments for small business, along with the best way to receive payments from clients if you are a freelancer or solopreneur.

Simple. You want to sign up for a payment service such as Square and/or Stripe. These two platforms are the most popular and since they’re the most popular, you usually have the option to integrate them into other platforms and/or services such as Calendly, Woocommerce, and more.

If you do not process payments online you are most likely missing out on revenue and should definitely consider integrating payment into your website as soon as possible.

Why You Should Accept Payments Online

Imagine you are online and you see something that you must absolutely have, for me, it is this Stapler and Tape Dispenser Set, but in order to get it you have to call and send a check. Are you going to go through all that effort or try to find it on another website that accepts online payment?

You’re most likely going to the website that accepts online payment because then the task is done. Speed, convenience, and the gratification of completion; these factors are monumental to clients.

You’re like okay girl we know that and that is why we came here to figure out the best way to receive payments from clients.

Things You Should Know About Accepting Payment

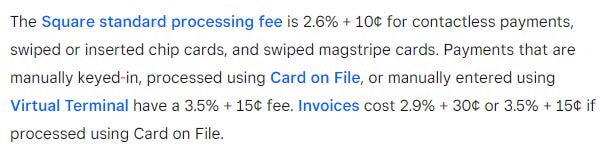

No matter the platform or service that you choose you are going to be charged a processing fee. There’s no way around this unless you run a strict cash-only business, or use personal payment service options such as Cashapp, Paypal, or Venmo.

Most payment processors charge a percentage plus an additional surcharge that is normally less than a dollar. I’m going to share my top 2 online payment options to get you started.

Square (Squareup)

Square is one of the most popular payment processors due to its flexibility and convenience, but sometimes the fees make me wince. Nonetheless, I stay with them, and here is why.

Square’s Features Keep Me Locked In

- Invoices — You can send your clients itemized invoices, quick invoices, and add taxes as needed, along with sending the invoice to them either by email or text message. You even have the option to manually send it if you want to send it directly from your email so that it doesn’t go to spam or something.

Now, how to accept online payments with Square? Easy when your client receives the invoice they have the option of paying with a credit/debit card, Paypal, Check or if you took cash you can log that on the invoice to keep your books balanced. - Contracts — This is one of the coolest features. You can create your own contracts and save them as templates. Another awesome thing is that if you and your client have agreed to pay based on milestones you can set that up as well. There is an additional cost for the milestone feature though, but I believe it is worth the upcharge for the convenience.

- Appointments — If you are a lash stylist, a home stager, or someone that needs a payment system that holds clients accountable Square is perfect for you. You can send customers to your booking page and require a card on file for no-shows or late cancellations. Plus, if you really want to hold them accountable you can require a deposit upon booking their appointment.

- App Integrations — There are two ways to do app integrations with Square. You can add apps to your Square account such as Tax Jar which helps with filing taxes or some platforms that allow you to sync your Square account to accept payments. I will say that off-platform Square integration isn’t the best, but it does work.

- Square’s Debit Card — This is a newer feature, but I find it handy. A client sends you a payment which then Square shows a balance. You obviously need to have a bank account or debit/credit card attached to your Square account.

However, with the Square Debit card if you have a balance in your Square account you can start spending right away. You have two options when transferring your funds to your actual non-square bank account.

You can choose standard which typically takes one to two days to process or you can go with instant transfer and the fee for that is (insert fee amount here).

There are other features such as email marketing and text messaging marketing that are available as a subscription. Additionally, you can purchase card readers if you are on location and want to process payment in person which is handy.

Now let’s move on to the second way on how to accept online payments.

Stripe

The best option for taking payment directly on your website without having to link to an outside source.

Why I love Stripe

The developer in me loves being able to integrate Stripe into apps and websites, but the business part of me loves that as long as I have my Stripe credentials and the app and/or service I want to use allows Stripe then payment is a breeze.

Stripe is a little tricky for non-techies because the interface is a bit confusing, but it is because of how much it has to offer. Everything that Square has Stripe has plus more. Here are a few of Stripe’s features:

- Accept Payment Internationally — If you are selling products worldwide, Stripe has you covered.

- Embeddable Checkout — You can actually take payment straight on your website since it will be embedded/coded into your website.

- Create Your Own Virtual Debit Card — This is really cool. If you have a nice size team working for you and you want them to pay for business items but not with their personal card you can create a virtual card and even get them a physical card if needed.

Go ahead and sign up for a Stripe account it is absolutely free, but of course, it has its own processing fees.

Accepting Online Payments

In my personal and professional experience, I recommend using both payment processors: Square and Stripe.

Square is best for service providers that want to send out invoices, contracts, market to their clients, and want an easier interface to use.

Stripe is for those that want to sell products or integrate payment into other apps/services. So, why not use both to maximize your profit?

Are You Ready To Start Accepting Online Payments?

I think you are.

Hopefully, this answers your question on how to accept online payments or accept payments for small business, but if not let me know. Leave a comment below or send me a message via Instagram, Twitter, or directly via email.

If you enjoyed this article on how to accept online payments or accept payments for small business or believe this article could help someone you know feel free to share it.